CELINA - Mercer County property owners will soon receive the first half of their tax bills for tax year 2023 reflecting a staggering spike in overall real estate valuation.

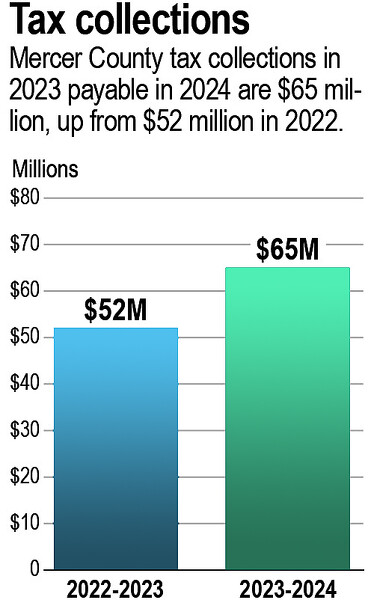

Total real estate taxes to be collected this year for tax year 2023 amount to $65 million, $13 million more than last year's billing cycle for tax year 2022, according to county treasurer David Wolters.

"These are historical changes in valuation," Wolters said.

Mercer County tax collections in 2023 payable in 2024 re $65 million, up from $52 million in 2022.

Residential property owners can expect to see a tax increase between 25% to 30% based on new real estate valuations determined by a reappraisal undertaken every six years. Actual tax payments, though, vary based on where a property owner lives in the county.

"We don't make the rules," said Sara Scott, the chief deputy of real estate in the county auditor's office. "We have to follow Ohio Revised Code, so we are mandated by the state with our valuation to represent market values."

Property owners have until Feb. 21 to pay their first half bill without penalty. Second half bills will be sent out around June 20 and must be paid by July 20 to avoid penalty.

Homestead and owner-occupancy credits can be applied to a tax bill, if applicable. More information on the credits is available by contacting the county auditor's office.

"I am very concerned about the financial impact of that increase to the citizens of this county," Wolters said. "If you have two working spouses, you may have some ability to generate some additional incomes, but if you are on a fixed income, it's more troubling."

Wolters said his office is willing to work with people to come up with a payment plan. But again, when someone is on a fixed income, it can be difficult for them to come up with extra dollars to cover their heightened tax burden.

Ohio legislators knew about the coming storm of surging property valuation as far back as April, Wolters said.

"Our expectations of taxes were off the charts," added county auditor Randy Grapner. "Our legislators were saying, 'We have to do something.'"

Wolters had hoped lawmakers would come up with a way to soften the blow to taxpayers, whether through a "phase-in" or by other means.

"After months and months of headlines and optimism of potential options, no impactful legislation was passed, which from my perspective is very disappointing," Wolters said.

After compiling the tentative results of the reappraisal, Grapner's office in September set aside dates and times for phone and in-person informal property review appointments.

The informal reviews served as educational sessions on the process used to determine valuations. Scott said 130 people participated.

In October, Wolters' office sent out notifications letting residents know of the expected hikes in residential property valuations and recommending they anticipate a 25% increase in property taxes.

With tax bills going out soon, property owners can now formally contest their property valuations by requesting a form from the auditor's office and returning it by March 31.

"Anybody can file if they feel their value is incorrect," Scott said. "After March 31 we will take everyone who filed complaints and we will look individually at each property then to do more of a individual assessment. Any information they turn in supporting their opinion of value is taken into consideration as well."

Supporting evidence could include a real estate appraisal from a certified appraiser or photographs of parts of a property in question.

Driven largely by a red-hot real estate market that shows no signs of slowing down, residential and agricultural properties surged between Jan. 1, 2020, to Jan. 1, 2023, the reappraisal determined.

Asked about the fluctuations in residential valuations, Scott said there are increases as low as 12% and as high as 60%, depending on the location.

Additionally, farmland valuations - determined by the state's Current Agricultural Use Value (CAUV) formula based on soil types - went up on average 100%, according to Scott.

"We're in the appraisal business. That's what we do. Sara watches all these sales happen. She's putting in all of the new construction. Value, we don't care. It is what it is, and we follow the sales. We can support our values," Grapner told the newspaper in September.

Appraisers worked to assess the roughly 29,800 real estate parcels that make up the county, looking for new improvements, or in the event of a natural disaster such as a tornado, structures no longer on a property.

"Our appraisal company that we hire … they're looking at multilinear regression. They're looking at statistical analysis constantly. We are looking and they are looking at all the sales information that we collect over three years," Grapner explained.

Data mailers were sent out to residential property owners asking them to confirm or adjust information on property record cards.

"A lot of information goes into reappraisal. We take all of those figures and see what we have, correct anything and then we start looking at the sales," Scott said.

The county has over 160 neighborhoods or market areas of similar housing that Grapner's office looks to during the revaluation.

"We do mass appraisals, not independent appraisals, so we look at market areas," Scott noted. "We will adjust properties according to their market area, and it can be anywhere from 12 properties up to 200-and-some-plus properties that will all adjust about the same."

Wolters said it's difficult to calculate a weighted average of tax increases for tax year 2023.

"That is a difficult question," he said. "The county has 29,000 parcels. We have 46 taxing districts. We have six school systems. We have 14 townships and it's not one size fits all."

A property owner's tax bill depends on a host of factors, including the taxing district in which they reside and the levies voted in there.

In Ohio, property tax rates are computed in mills. Inside millage is provided by the state's constitution and levied without a vote by the people. Ohio's Constitution allows for 10 mills of inside millage to be shared by public schools, counties, townships and other local governments.

Then there's voted-in countywide and school levies. Most levies collect a certain dollar amount. The millage rate is periodically adjusted based on changes in property valuations in order to generate the same amount of money each year.

With property valuation growing exponentially, one would expect school levy millage to drop accordingly. But that's not always the case.

Ohio law stipulates that a school's effective millage rate cannot drop below 20 mills, preventing some levies from decreasing in millage even if property valuation climbs.

"The state of Ohio Department of Taxation gives us orders that we will move the schools back to the 20-mill floor. So they get an increase in millage because of that legislation," Grapner said.

"That is a function of the school financing passed by the legislature years ago," Wolters said. "All of our schools now in the county are at the 20-mill floor."

Some school levies in the county dropped in millage, others didn't, Wolters said.

"But the 20-mill floor has kept some of that millage at the floor," he said.

Total valuation of all Mercer County school districts combined rose from $1.186 billion in tax year 2021 to $1.718 billion in tax year 2023.

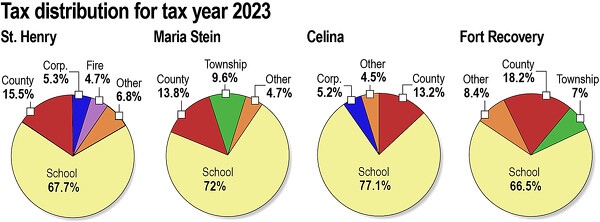

Tax distribution percentages for a few communities in Mercer County.

The $65 million to be collected this year will be disbursed to various governmental entities based on inside and/or outside voted tax millage.

But the bulk of the pot goes to school districts.

For instance, in tax year 2023, Fort Recovery Local Schools would get 66% of taxes in its district, St. Henry Consolidated Local Schools 68%, Marion Local Schools 72% and Celina City Schools 77%, according to information from the auditor's office.

Unlike other taxes, property tax revenue stays local, Wolters pointed out.

"This is an investment in your county," he said.